The Signal Group offers an exhaustive overview of the trends in the dry bulk and tanker markets that both defined 2021, and offer a glimpse as to what might be in store for 2022 and beyond.

Using Signal Ocean data, give the insight to analyze the trends and changes across the major vessel sizes in the dry and tanker freight market for 2021. This time last year, Signal Group analyzed the effects of the coronavirus pandemic on commercial shipping with a focus on dirty tankers – VLCC, clean tankers – LR2 and dry – Capesizes.

With the end of 2021, global eyes are on Omicron and whether or not it will significantly reduce economic growth. The world economy is said to be experiencing just 0.7% growth, in the final three months of the year, according to Bloomberg estimates, which is half the growth of the previous quarter and below the pre-crisis rate of around 1%.

Dry – The big picture and smaller vessels

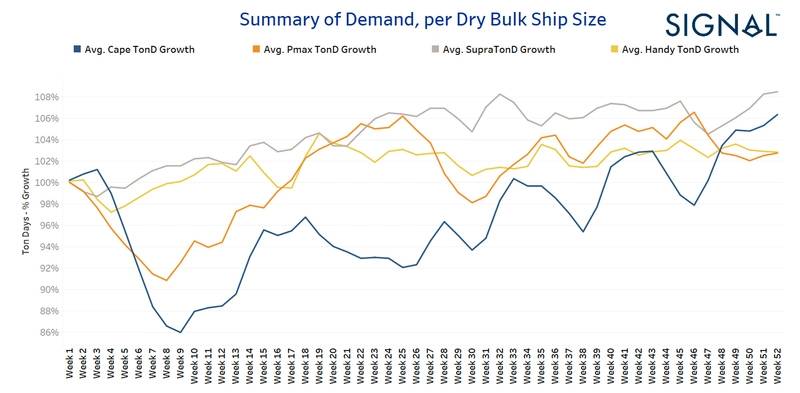

The big challenge for the evolution of seaborne demand for dry vessels is the performance of the Chinese economy. Signal Ocean estimated the demand in ton days growth for this year per main dry bulk ship size and it envisages a clear higher trend of growth for the Capesize segment, (chart 1), that boosted the sentiment of Capesize freight rates during October to the highest level since 2009. The question now is what about 2022? There are some early indications signaling a lower expansion in the growth of China, the world’s second largest economy, that will influence the evolution of demand for seaborne transportation for Capesize vessels. Market consensus is that the growth of China’s economy will vary from 5% to 5.5% in 2022.

Chart 1: Signal Ocean Data| Dry, Ton Charts, Demand in Ton Days % Growth, Year 2021, per Quarter and Month

Chart 1: Signal Ocean Data| Dry, Ton Charts, Demand in Ton Days % Growth, Year 2021, per Quarter and Month

Tankers – Demand crude and product

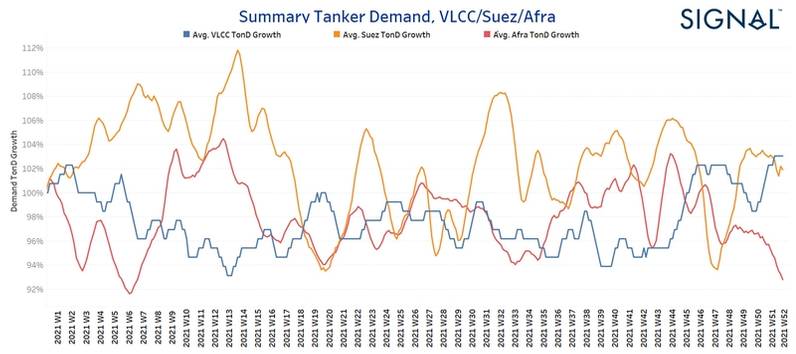

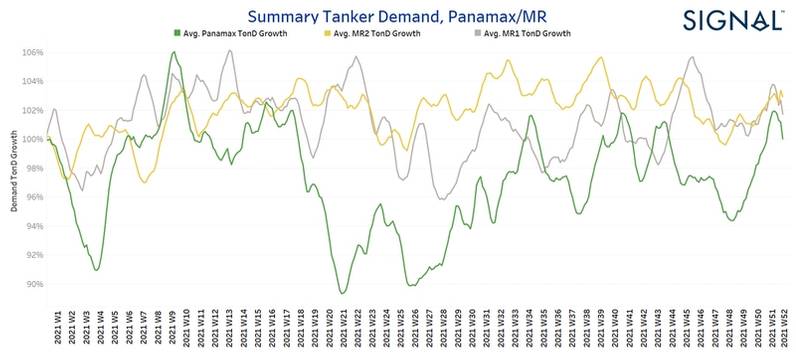

2021 ends with significant recovery in demand for Very Large Crude Carriers (VLCCs), whereas the last quarter has seen downward movements for Suezmax and Aframax vessels (chart 2). In the product segment, demand gives signs of slowing down with December ending at lower levels than the levels of the beginning of the fourth quarter. It is worth mentioning that MR1 vessel size keeps firm growth as we are heading towards the coming days of the new year (chart 3). The challenge on the growth for seaborne demand on crude and product for the upcoming demand growth in ton days is the current daily rising of covid cases. There are fears of the impact of the Omicron variant on oil demand with EIA, OPEC and the US Energy Information Administration concluding at different positions of estimates for the next year. The IEA in December’s Oil Market Report (OMR) estimated global oil demand to rise by 5.4 mb/d in 2021 and by 3.3 mb/d in 2022, when it returns to pre-pandemic levels at 99.5 mb/d.

Chart 2: Signal Ocean Data| Crude Tankers, Ton Charts, Demand in Ton Days % Growth, Year 2021, per Quarter and Month

Chart 2: Signal Ocean Data| Crude Tankers, Ton Charts, Demand in Ton Days % Growth, Year 2021, per Quarter and Month

Chart 3: Signal Ocean Data| Product Tankers, Ton Charts, Demand in Ton Days % Growth, Year 2021, per Quarter and Month

Chart 3: Signal Ocean Data| Product Tankers, Ton Charts, Demand in Ton Days % Growth, Year 2021, per Quarter and Month

© Kalyakan / Adobe Stock

Freight rates

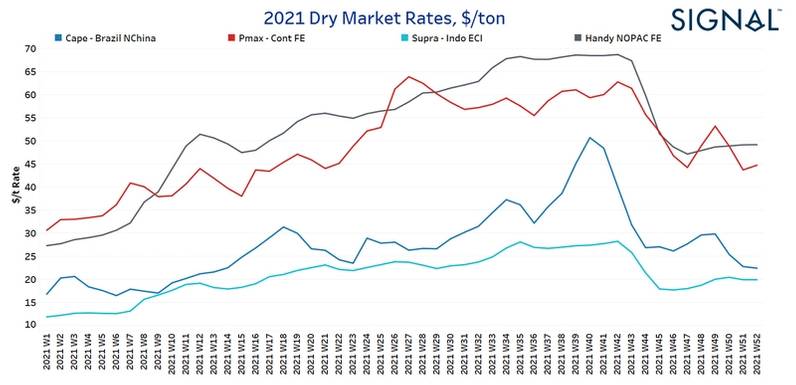

The evolution of dry market rates for the current year, chart 4, is undoubtedly one of the most profitable that dry bulk shipowners have seen lately, with rates following the ending of summer season surging to 10-year highs. It was a year for Capesize and Panamax vessels, but it ended with a year of stronger performance for smaller vessels. The Handysize segment has shown signs of firm rebound over the last weeks of December, when Capesize and Panamax vessels are facing constant headwinds in the upward movement of rates. The fears of a weaker Chinese economic growth and the ongoing cuts of steel productions for a greener future pose a serious challenge on the euphoria of earnings for the large vessel sizes. The energy crisis in China that came suddenly in November with a significant volume of Indonesian coal imports boosted the sentiment of Panamax rates, however, now the issue seems resolved and vessel earnings are showing more volatility towards lower levels.

Chart 4: Signal Ocean Data| Dry Market Rates, $/ton, per Main Dry Bulk Ship Size & Route

Chart 4: Signal Ocean Data| Dry Market Rates, $/ton, per Main Dry Bulk Ship Size & Route

Bunker prices

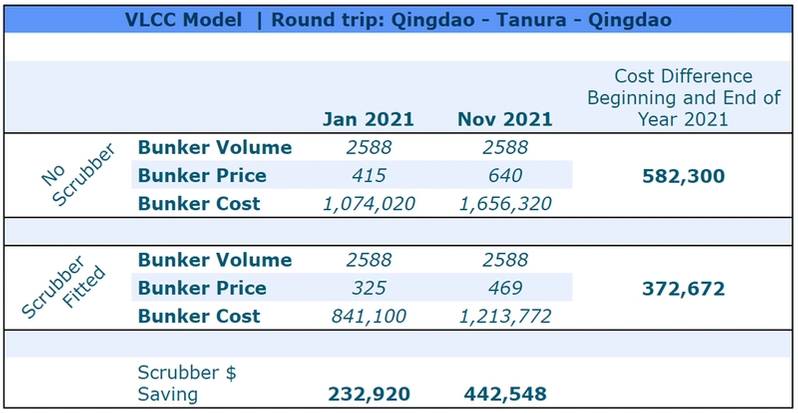

Compared to the turmoil of 2020, this year has been relatively straightforward for bunker prices – they have only really moved one way – up. January 2021 saw prices for VLSFO in Singapore start at around US$415 per MT and reach US$640 by the end of November, representing gains of more than 50% before falling to US$600 per MT on the back of Omicron-fuelled fears of a global economic slowdown. Of more interest however has been the spread between high and low sulphur grades of fuel oil as the world has attempted to return to normal after the turbulence of 2020. The year started with low sulphur grades attracting a premium of less than US$100 per MT, before increasing to US$120 by the summer and then widening to almost US$200 by the beginning of December. In real terms, this means that the voyage costs of shipping companies have increased by 50% in 2021 and scrubber-fitted vessels have enjoyed more cost benefits as the year has progressed.

Table 1: Data Source| The Signal Ocean Platform

What does this year say for 2022?

Overall, identifying the winning vessel class of 2021 is not an easy task. 2021 will be remembered for the exceptional bounce back that dry Capesize bulkers experienced. The changed momentum for the large crude carrier vessels and significant spike moments in LR2 product tankers is not to be forgotten, too. The demand trend, in ton days, supports a healthy momentum of freight rates for Capesize bulkers, whereas the crude tankers are going to face the impact of fears from Omicron variant on demand. However, the supply trend of December supports the gradual recovery of the tanker freight rates. The issue of Chinese port congestion seems to remain in the same focus for the first days of the new year and will determine the evolution of dry freight rates. Lastly, the energy crisis with Chinese efforts to decarbonize their power sector has triggered an intense debate over the last days on securing smooth energy transition and the changes on fuel demand landscape and prices.

Source: www.marinelink.com

Image: www.pexels.com